“JGBs are a dead market.” Until just a few years ago, this was the consensus echoing through the halls of foreign investment banks.

With the Bank of Japan (BoJ) vacuuming up nearly every bond in sight, the “policy-driven market” left zero room for professional traders to maneuver.

Fast forward to January 2026, and the landscape has shifted violently.

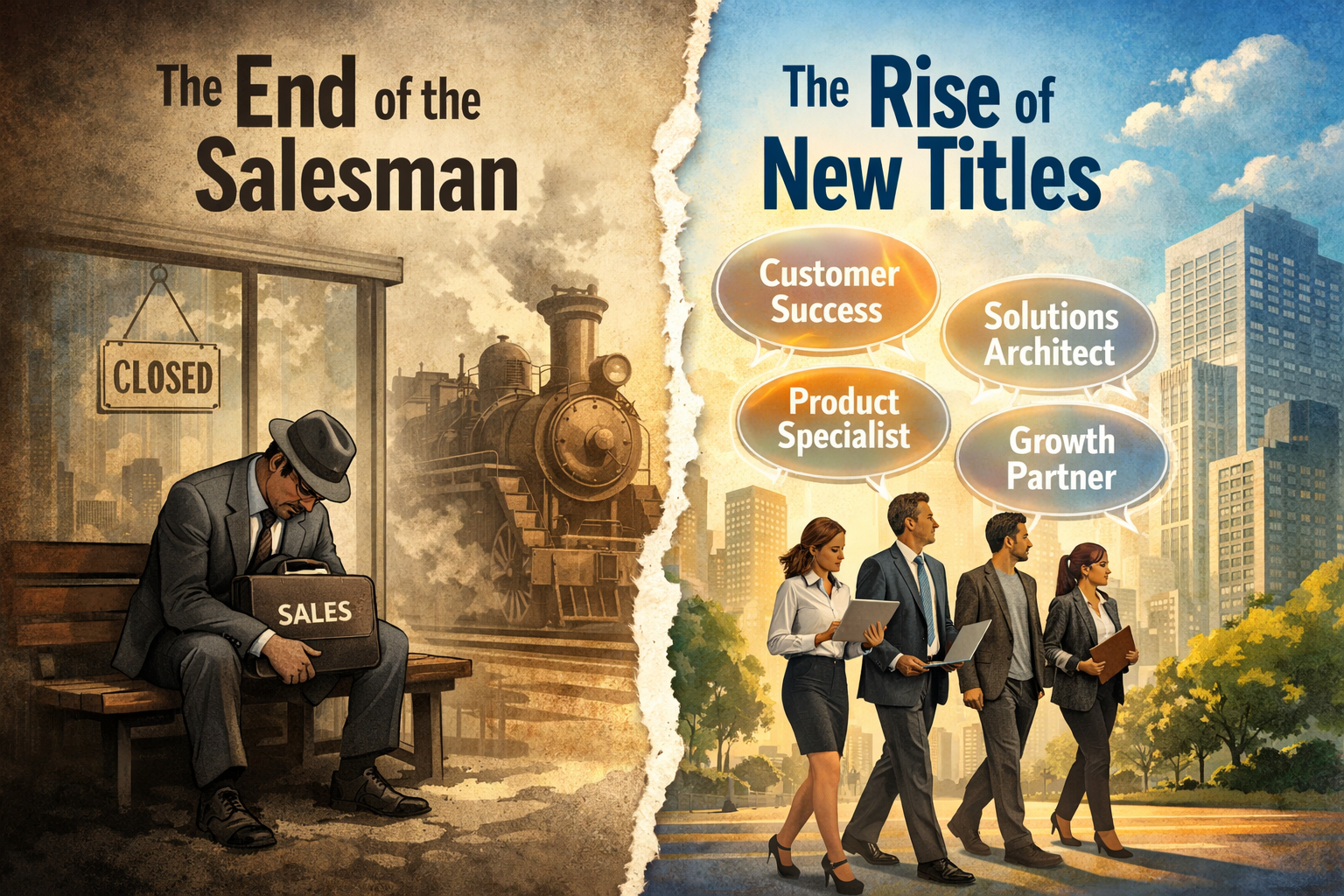

My phone is ringing off the hook.

“Do you know any skilled JGB traders? We’ll pay ¥40 million—no, ¥50 million ($350,000+ USD).”

To my former colleagues at Japanese mega-banks, this sounds like a fantasy.

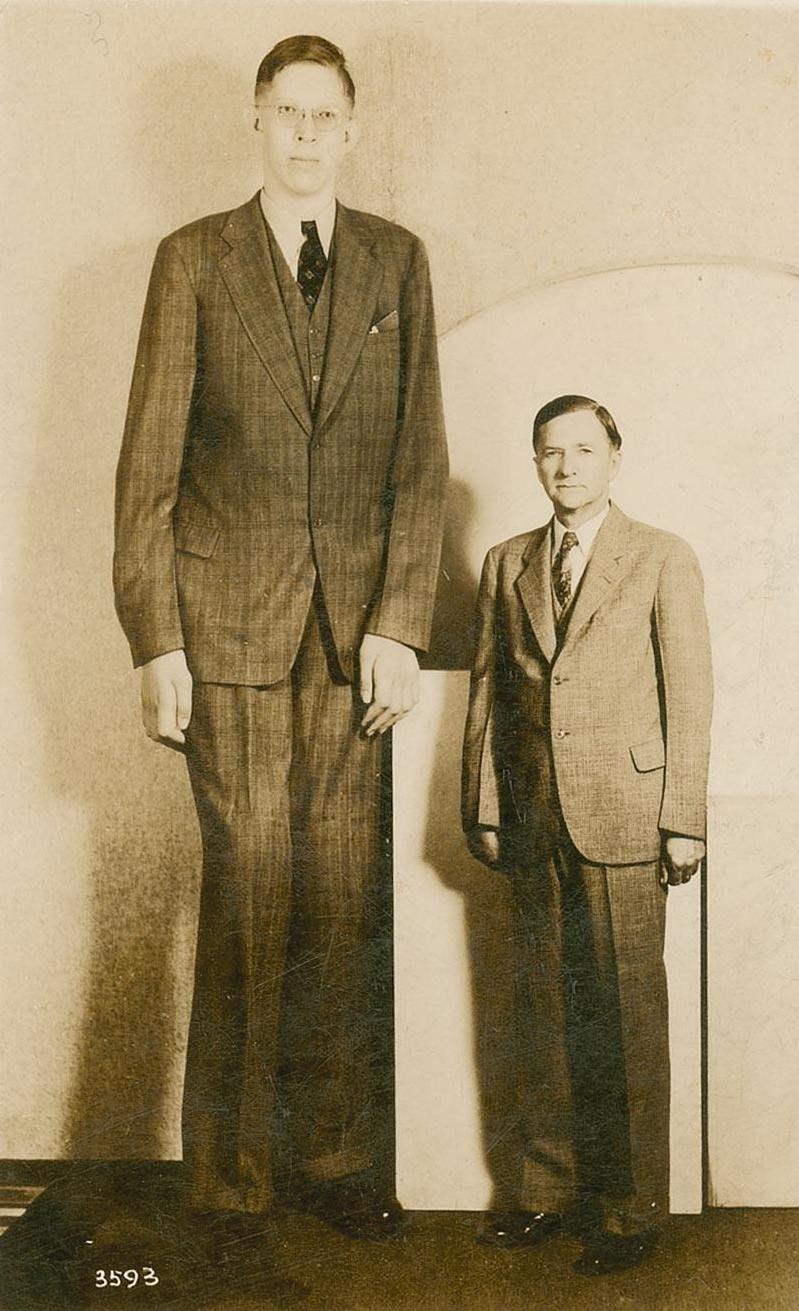

But behind the scenes of this ¥1 quadrillion ($7 trillion) market, a dramatic “changing of the guard” is taking place.