“Here we go again,” was my honest reaction when I heard the news that five individuals, including a former vice president, had been convicted in the SMBC Nikko Securities market manipulation case.

Immediately, the thought crossed my mind: “They’ll probably get off with a slap on the wrist, as usual.”

The Tokyo District Court reportedly harshly criticized SMBC Nikko’s corporate culture, stating that “the company’s internal culture and organizational structure itself permitted illegal price stabilization,” as if it were someone else’s problem.

But do many people living in this country genuinely believe this will preserve the integrity of Japan’s financial market?

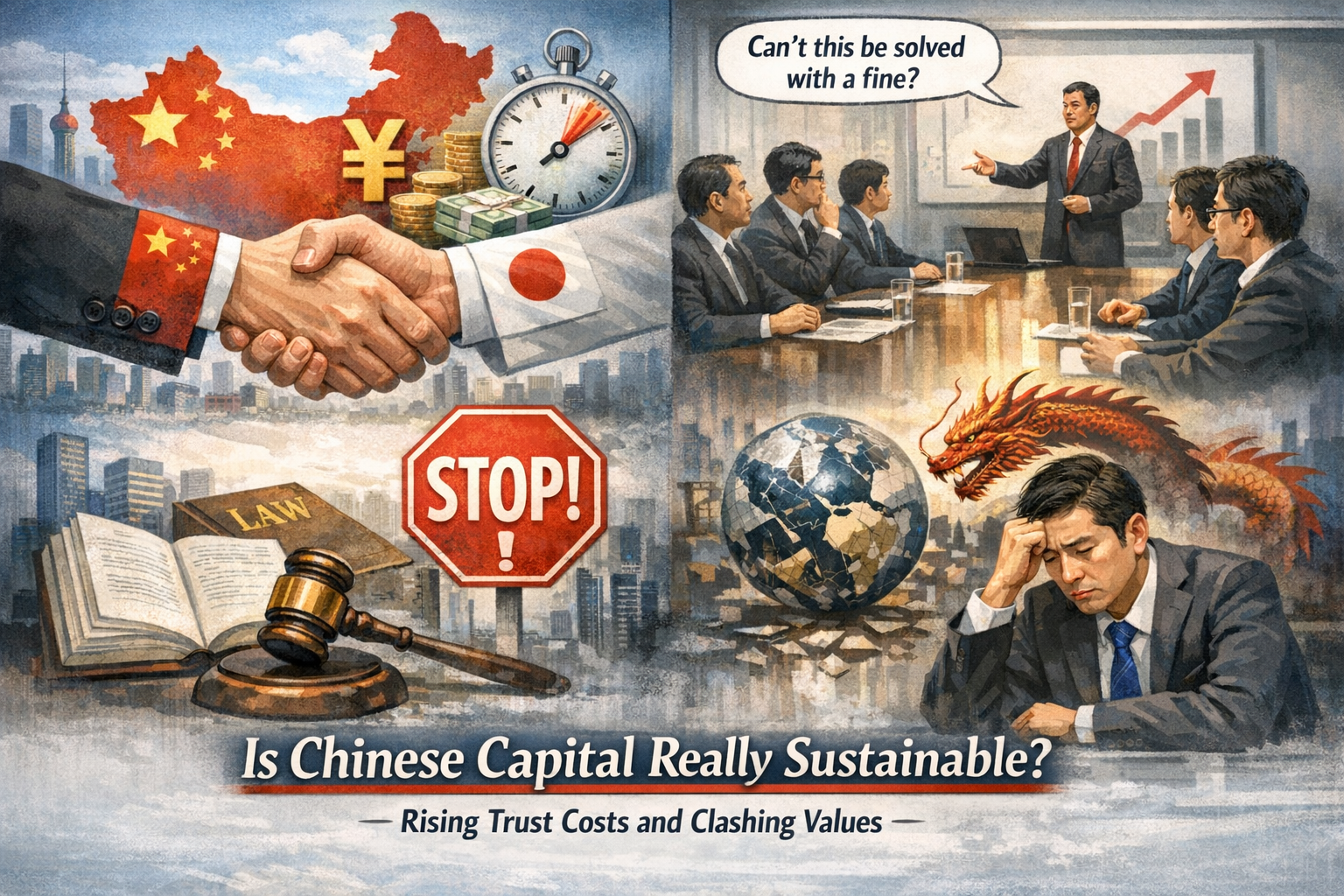

I began my investment banking career in the United States, managing literally astronomical sums of money for many years.

I now run a fund in Singapore, but as someone who has experienced both the Japanese and U.S. financial markets firsthand, I can unequivocally state that Japan’s financial system is far too lenient on financial crime.

This is precisely why the same problems keep recurring.

As long as this “suspended justice” prevails, there will be no end to vulture funds from overseas plotting mischief in Japan.

Because for them,