“How could this happen?” You’re not alone in asking this question.

We are witnessing a turning point that future history textbooks will highlight in bold letters.

Many individual investors likely suffered losses in the recent market turmoil.

Yet, whether you’re an individual or a large institutional investor, remember: the ultimate responsibility for your investment decisions lies solely with you.

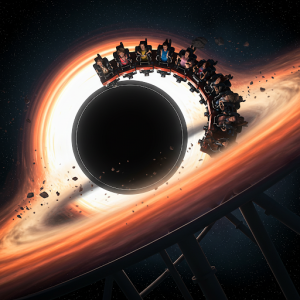

In a market that swings like a roller coaster, financial black holes capable of mercilessly devouring your assets coexist alongside golden fountains of unimaginable wealth.

If you’ve chosen to enter this dangerous yet fascinating investment world, there are certain principles you absolutely must grasp.

I am a fund manager based in Singapore, managing trillions of yen in assets.

I began my career at a major foreign investment bank in Tokyo, on a trading floor that felt like a battlefield—filled with blood, sweat, and gunpowder.

Though satisfied with my high salary at a young age, I often felt overwhelmed when exchanging ideas with highly skilled fund managers at major global funds.

It was like experiencing firsthand the difference between Japanese professional baseball and Major League Baseball (MLB):

the rewards and meritocracy were on completely different levels.

Realizing “I can’t stay like this,” I began actively seeking opportunities to move to a major global fund.

Like a hungry beast, I absorbed information and relentlessly honed my analytical and decision-making skills.

Ten years ago, I finally secured my current position, beating out 30 strong rivals.

The excitement I felt when finally taking the seat I had long aspired to remains vividly etched in my memory.

Now, I’d like to share my perspectives from the frontlines of the market.

My intent isn’t to criticize from a position of superiority.

Rather, I wish to protect individual investors from unnecessary losses and malicious traps.

I rarely share my insights publicly.

Honestly, I don’t know if my words will truly resonate with you, but I will speak candidly, unconcerned with what others may think.

In this two-part series, I’ll present six characteristics common among investors who lose money.

1 Losing Investors Refuse to Face Reality