※Translated with Notion AI. (Plus version)

The bankruptcy of “Funai Electric.”

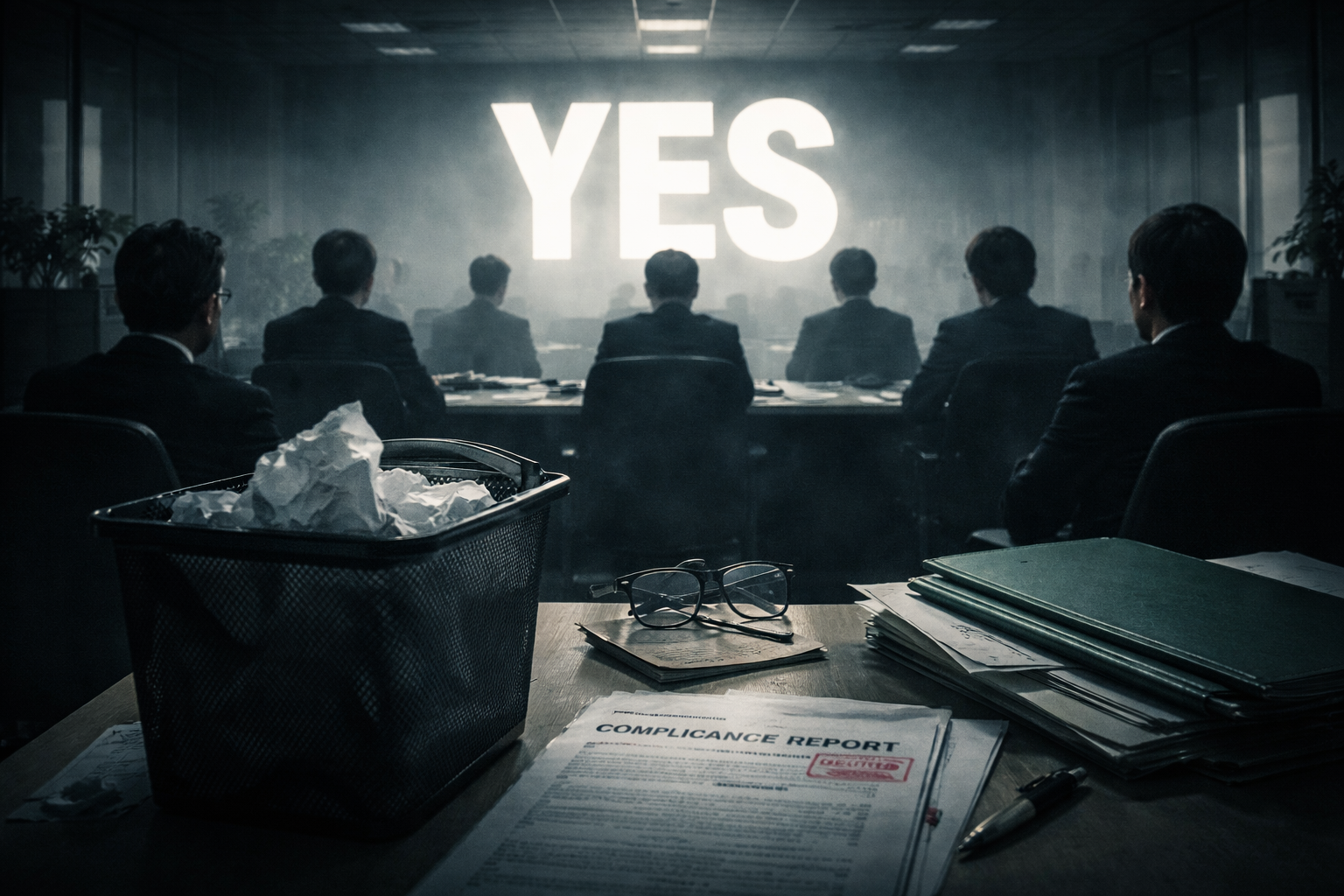

This situation has highlighted how the leniency of Japanese administration and legal systems is causing significant pain to employees and investors.

While the impact of bankruptcy proceedings should be minimized and dismissals and compensation should be carried out in a better manner, the sudden announcement and inability to pay have further accentuated the opacity of the Japanese market in the eyes of foreign investors and corporate executives.

In response to this, my subordinates who have long worked in consulting accept this calmly, saying “Such situations are common in Japan.”

However, from the perspective of international investors and sophisticated managers, they would feel that a cautious approach is essential when investing in Japanese companies.

The strategy of large funds like KKR reflects that unless they gain complete management control, not just investing, they may face unexpected risks.

There are many lessons to be learned from this bankruptcy drama, but I would like to re-emphasize two particularly important lessons.