※Translated with Notion AI. (Plus version)

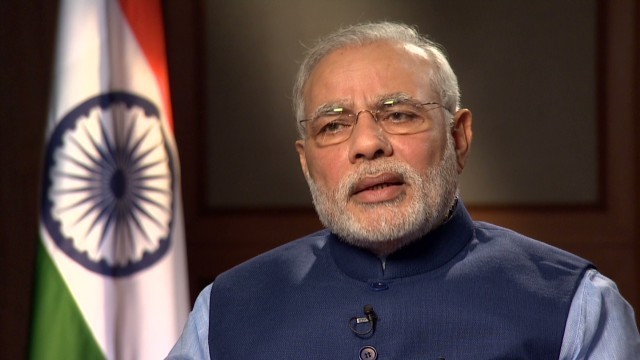

The future of investing in India is both attractive and requires caution.

In some circles, India is gaining attention as an excellent investment destination.

This is on a completely different level from the risk of falling into a “short-term boom” like Vietnam and Sri Lanka have experienced in the past.

Vietnam achieved rapid growth, but its growth has now stagnated.

Sri Lanka, once touted for growth by financial institutions, is now facing a critical economic situation.

In contrast, India has different potential and should not be simply compared to these countries.

However, it is dangerous to compare India to China.

India cannot swiftly implement powerful economic policies like the Chinese government can.

India’s growth is gradual, with delays in legal infrastructure and social issues posing significant hurdles.

Nevertheless, if legal systems are developed and obstacles are resolved, India has the potential for long-term sustainable growth.

Let’s continue to delve into the specific risks of investing in India.

Risk 5. Challenges in Education and Healthcare

While India is making progress in education and healthcare globally, access to these services remains limited, especially in rural areas and among low-income groups.

Disparity in education quality:

While opportunities for quality education are increasing in urban areas and for middle-class and above families, educational infrastructure in rural areas is insufficient, with many people unable to even read or write.

This educational gap is also one of the causes of income disparity.

In India, there’s a misconception that English is the official language and that most people can speak English.

It’s said that about 10% of the population, or about 125 million people, can speak English.

Including those who speak broken English, it’s said to reach 300 million, but in conclusion, it’s about 20%.

My Indian friend had live-in domestic help for his family.

None of them could speak English.

However, my friend provided online learning for the children of that family.

Later, one of those children was able to enter the Indian Institute of Technology (which has several campuses), India’s top-ranked university, and joined my friend’s company.

That child’s parents cannot even write.

Lack of healthcare:

Medical facilities are concentrated in urban areas, making it difficult to receive adequate medical care in rural areas.

Furthermore, for low-income groups, medical expenses are high, causing illness to strain household finances.

It’s not just that medical costs are high.

There is also a severe shortage of doctors and medical facilities for ordinary people and poor families.

Until just 10-15 years ago, India didn’t have an aging population problem.

The reason was the low survival rate due to poor medical facilities.

Recently, while the supply of medical facilities has begun to increase somewhat, advances in pharmaceuticals and their free distribution have significantly improved infant survival rates.

By the way, the world’s first cow-powered ambulance has been born in India.

Effective Utilization of Over 5.5 mm Stray Cattle as Slaughter is Prohibited

Risk 6. Political and Social Challenges

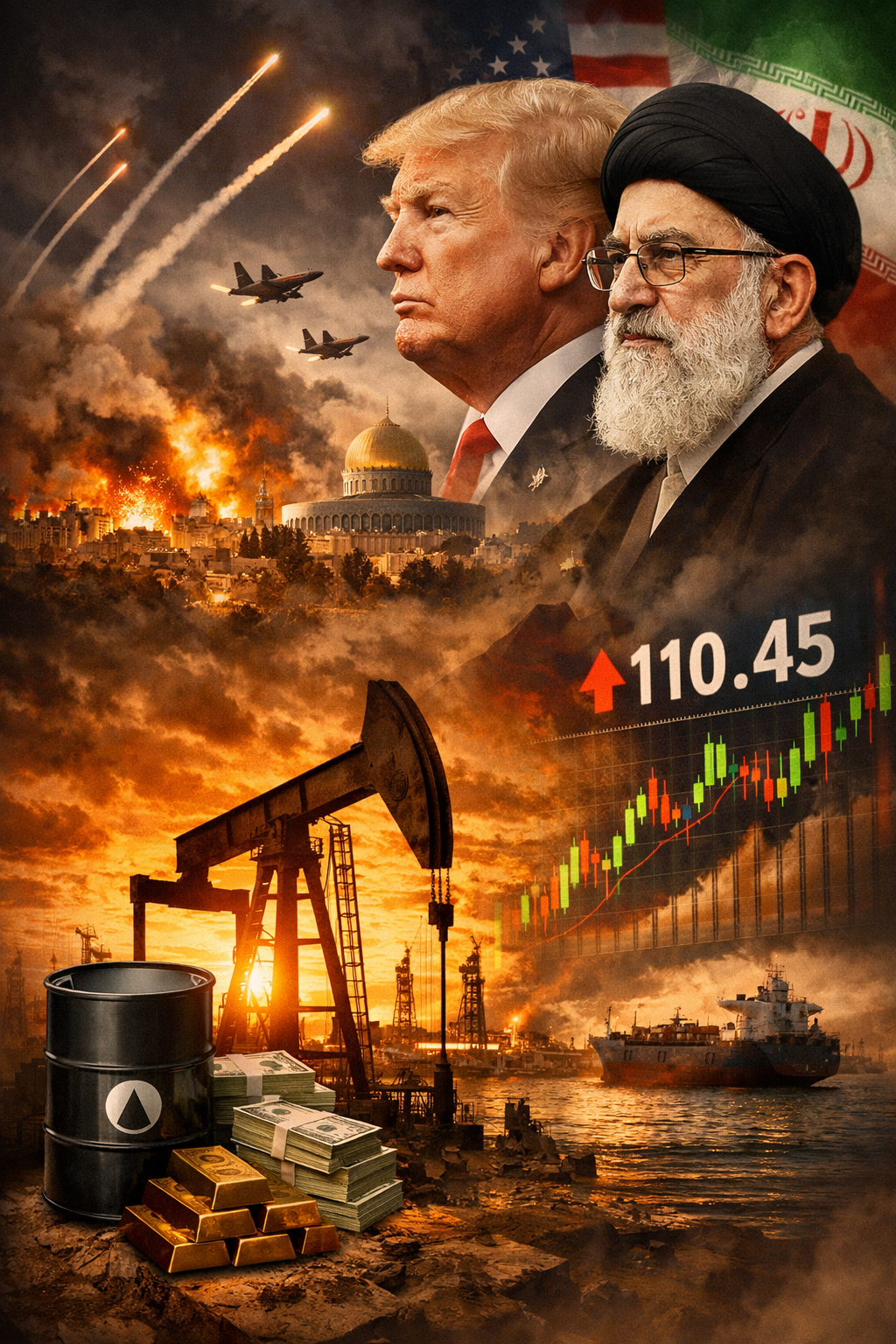

As India is a country where diverse cultures and religions coexist, social tensions and political conflicts also lurk behind economic growth.

Religious conflicts:

Religious tensions between Hindus and Muslims are increasing in some areas, sometimes leading to violent clashes. This can negatively impact regional stability and economic activities.

Influence of the caste system:

Although the caste system is legally prohibited in India, its influence remains strong, with people from lower castes in particular being placed at economic and social disadvantages.

(Letter to Investors)

While India has achieved many successes in its economic growth, it faces challenges such as social disparities, inadequate infrastructure, environmental issues, and labor market instability.

Unless these issues are addressed, India’s growth will be limited to certain segments, and resolving these challenges is essential to achieve sustainable and inclusive growth.

The Indian market is truly a treasure trove of opportunities.

Looking ahead to future economic growth, companies and sectors that effectively address the country’s challenges have the potential to generate overwhelming returns.

In particular, when foreign companies enter India, they often fail to fully understand the unique customer preferences and business strategies, leading to unsatisfactory results.

However, this is precisely where there is great room for differentiation.

I have been closely watching India’s financial markets for many years, and I have strong expectations for individual Indian stocks compared to live stocks from other countries.

While there are few securities companies in Japan that can conduct high-level analysis of Indian companies, I know that some companies in Singapore provide excellent analysis.

If you’re interested in investing, it’s never too early to start learning about Indian stocks.

However, to succeed in investing, are you investing large sums in mutual funds, thinking it’s safe to leave it to professionals?

That could be a dangerous misconception.

While growth is expected for companies in emerging countries, many lack a solid foundation for accounting audits, which carries risks.

Moreover, it’s not guaranteed that investment trust management professionals frequently visit the companies they invest in and conduct thorough research.

Investment management in countries with geographical differences, religions, languages, and business practices different from developed countries is complex and difficult.

Many managers tend to diversify their investments to cover these difficulties, but this doesn’t necessarily lead to risk reduction.

The basics of investing are not “how to make money” but “how to protect assets.”

And the strongest weapon in investing is “liquidity.” Remembering this, starting with investing in live stocks would be a wise choice.

Individual Indian companies are unparalleled exciting investment destinations.

While I don’t recommend it, it’s certainly worth learning about their potential once.