※Translated with Notion AI. (Plus version)

With the newly formed Ishiba administration and coupled with the U.S. employment statistics, the dollar-yen exchange rate is approaching 150 yen.

In an unstable market where rates can fluctuate by 4-5 yen in a single day, even professionals find it difficult to predict, making it a very risky situation for general investors.

In such an environment, it is crucial to make calm judgments without being swayed by countless pieces of information.

Additionally, having worked in European and American investment banks for over 30 years, I am frequently approached by salespeople from banks, securities firms, and insurance companies recommending “foreign currency transactions” or “products with high exchange rate risks.”

They must be quite profitable.

Perhaps you have also experienced such product proposals. However, I would like you to calmly consider the following three points.

Three Points to Keep in Mind to Protect Your Assets That Salespeople Don’t Tell You

- What is the “appropriate dollar-yen exchange rate” based on the current Japanese economy and wages? Is there an appropriate level for exchange rates, and how should it be evaluated?

- How to understand “good yen depreciation” and “bad yen depreciation” How to judge not only stock prices but also long-term impacts.

- How much can we rely on analysts’ comments? It’s important to understand the background without blindly accepting the opinions of bank and securities company analysts.

Are there any representatives who have clear answers to these questions?

If not, you may need to reconsider the risks of that product.

When I asked the same questions to professionals who are still well-versed in the foreign exchange market, the response was,

There is no answer.

Determining an “appropriate” exchange rate is like seeking a comfortable temperature.

If we consider the phenomenon that summers seem longer than before,

1. What is the most comfortable temperature in the first place?

It’s meaningless to ask such a question.

2. How can we stop global warming and return to previous temperatures?

This discussion is also meaningless for non-experts (discussion on structural changes in exchange rates)

If that’s the case,

3. Why weather forecasts have become less accurate, how to cope with the heat

(How to deal with yen depreciation)

It’s more constructive to think about these points.

There is no fixed correct answer in the foreign exchange market. Whether centered on the Japanese yen or the US dollar, and considering market structure, the factors affecting exchange rates are diverse.

If pressed, the answer to foreign exchange lies in “actions adapted to the environment.”

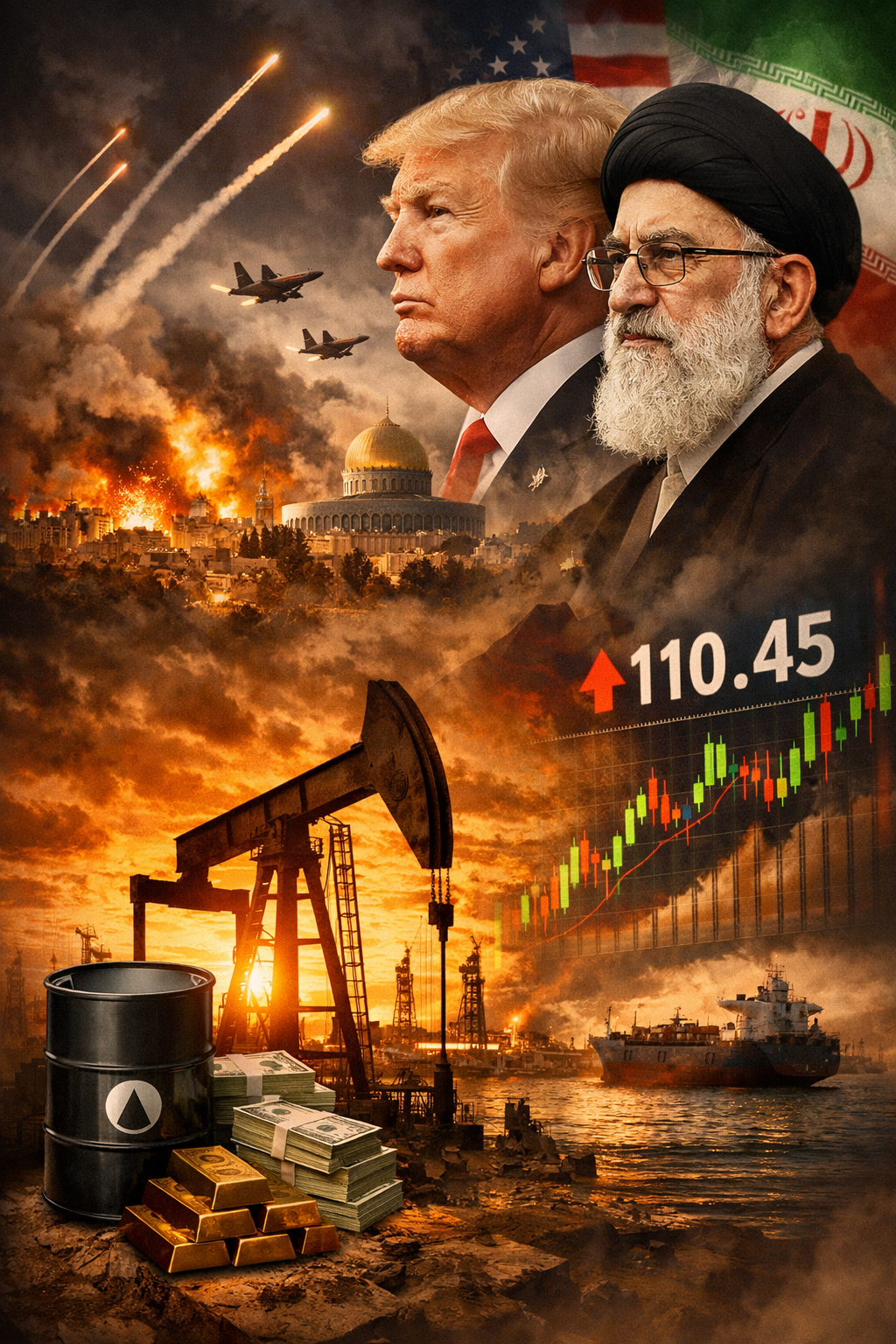

This year, there have been successive changes of government in Europe, America, and Asia, and the US presidential election is also approaching.

It’s necessary to pay attention to how these movements will affect the foreign exchange market.

UK

Singapore

Understanding the short-term factors affecting exchange rates is important for forecasting future trends.

If you understand the factors causing market fluctuations, you should be able to see how to act.

In such a turbulent market environment, we can rely on the insights of Mr. Snow White, also known as the “Sage of Seren.”

Please reconfirm the following points that he has emphasized in the past and use them as guidelines for future market behavior (please select “Snow White” from the contributor archives on the right side of the HP).

☞ The shelf life of exchange rates is extremely short. There’s no meaning in predicting the market even a week ahead.

☞ Understanding the factors of change is important. It’s essential to grasp the fundamentals.

☞ Determine your position in the dollar-yen exchange rate. Clarify whether you have a geocentric (Japanese yen-centered) or heliocentric (US dollar-centered) perspective.

Mr. Snow White’s “Market Fixed-Point Observation” will be delivered weekly from now on, providing a valuable opportunity to learn about the latest global trends in real-time.

Please make use of it to maintain a broad perspective and make calm judgments without being swayed by fragmented information from social media and other media.

It will be an opportunity to objectively grasp the movements of the foreign exchange market and gain wisdom to protect your important assets while staying in Japan.