※Translated with Notion AI. (Plus version)

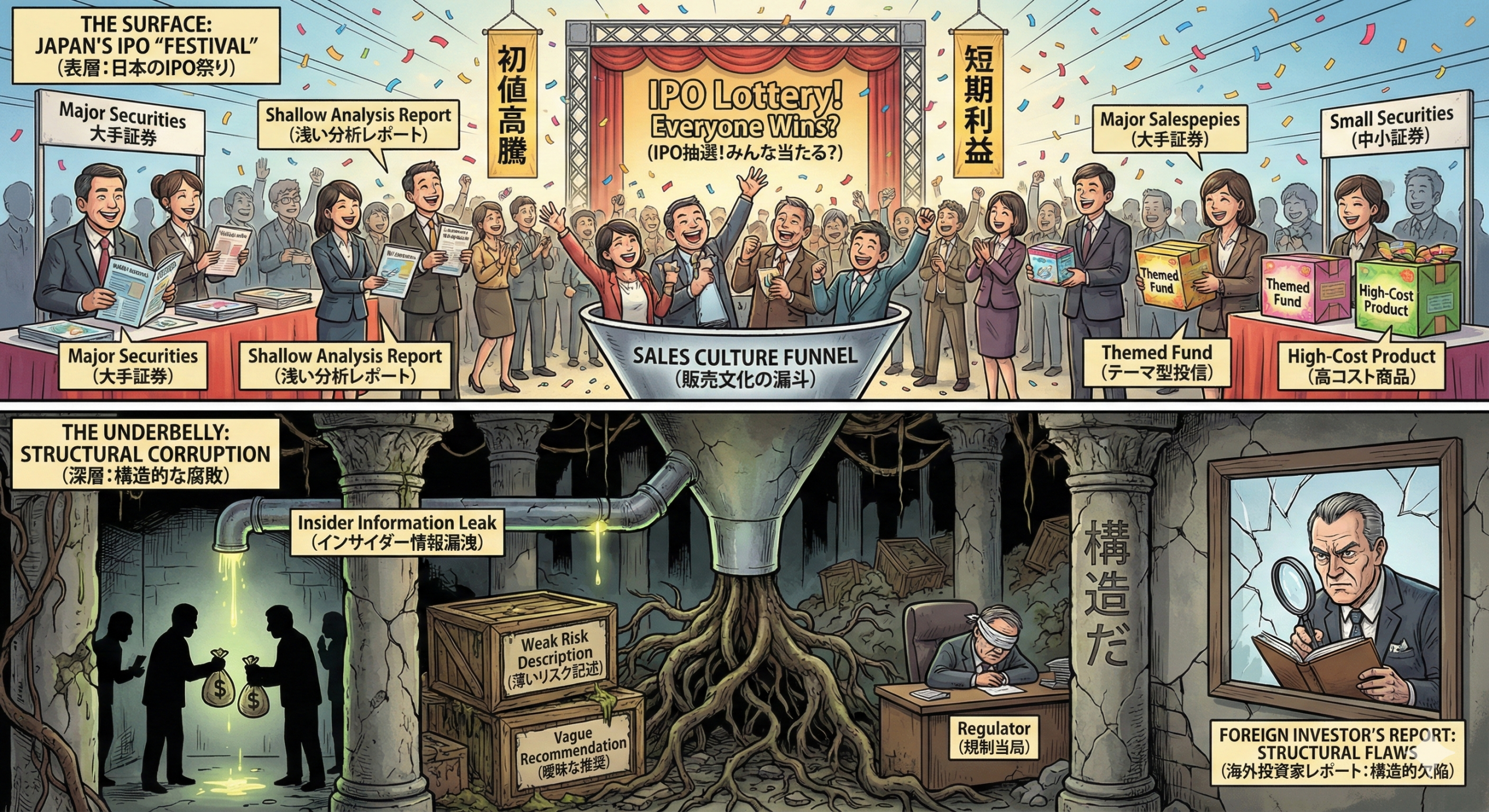

The new NISA (Tax-Free Small Investment System)in Japan started start in January 2024, and interest in investment trusts is growing.

However, there are currently about 6000 funds in Japan.

Don’t you feel overwhelmed by the sheer number?

Among them, very few funds achieve remarkable returns.

Why is that?

It seems like Japan is a free-for-all for sales companies.

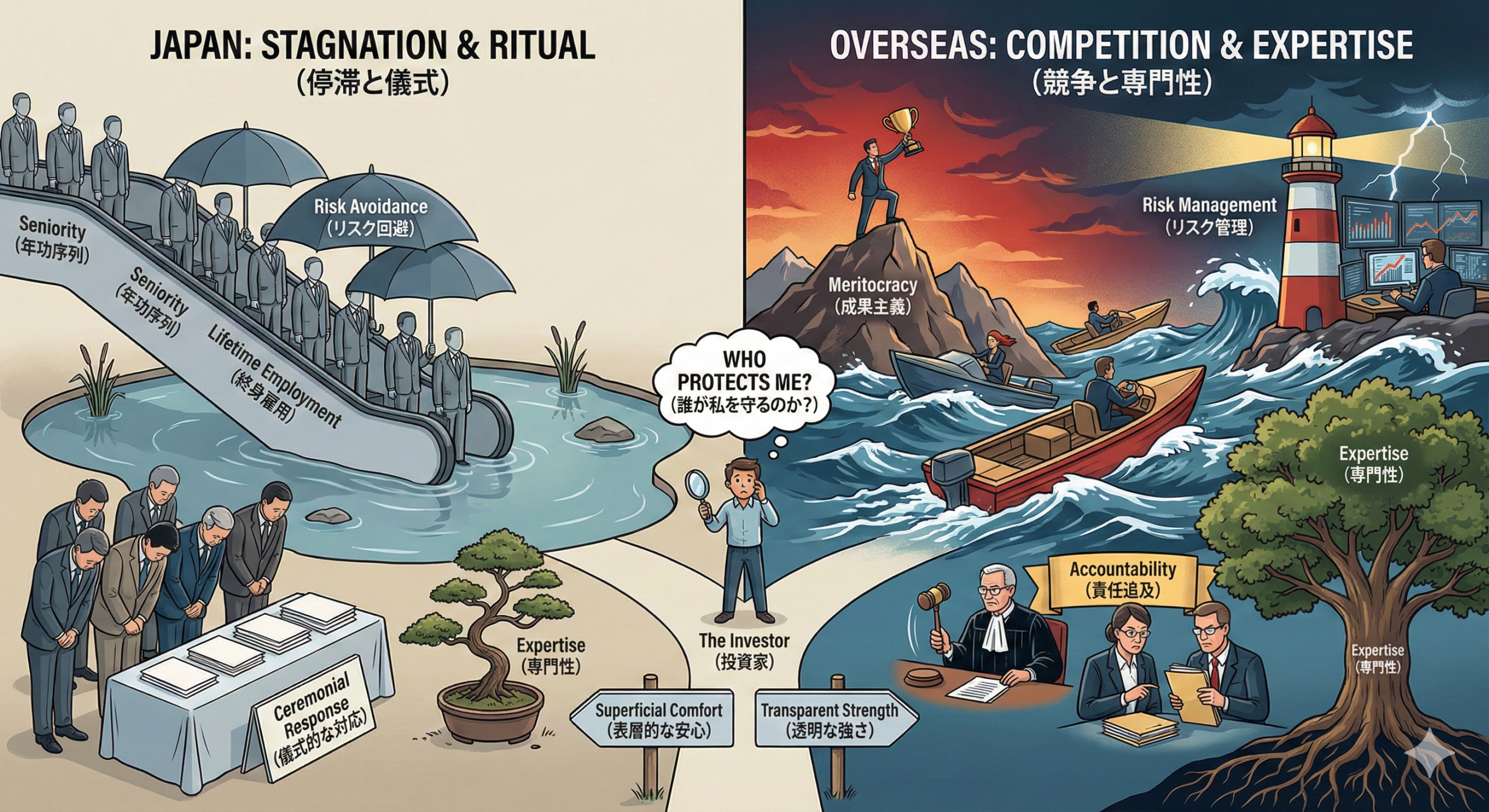

The media mentions “differences in regulations,” “tax issues,” and “a culture of avoiding high risk” as reasons, but the explanation that “Japanese investors are conservative and avoid high risk” is particularly hard to grasp.

In reality, many individual investors are at a level where they don’t even know about neighboring Asian countries, yet they are being guided towards high-currency-risk products like “currency selection type.” Currency risk is extremely high, and emerging market currencies are particularly difficult to predict even for professionals.

Even with the familiar dollar-yen pair, the highs and lows are so volatile that anyone can understand the high level of risk.

There is Actually Another Problem

The real reason why you can’t invest in amazing funds from Japan is more fundamental.

It’s because “they are not interested,” “they choose funds that are easy to sell and have high fees,” and “the level of understanding of sales companies.”