※Translated with Notion AI. (Plus version)

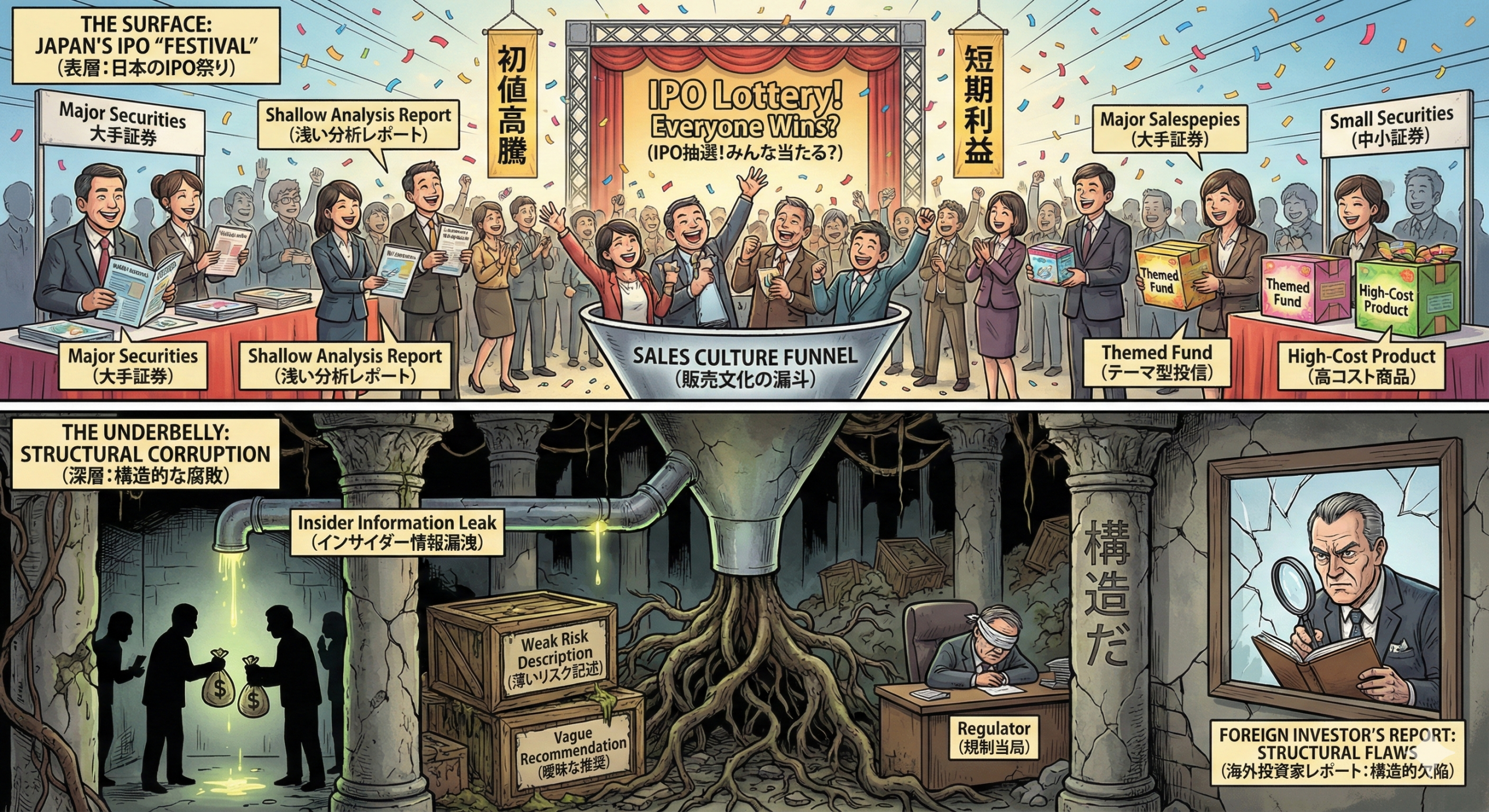

Including NISA, there has been a growing amount of fund investment solicitation from salespeople at Japanese financial institutions.

Almost every day, I receive calls, emails, and visit requests from nearly 10 companies.

It’s my fault for opening accounts recklessly, but the repetitive sales pitches are quite unsatisfactory.

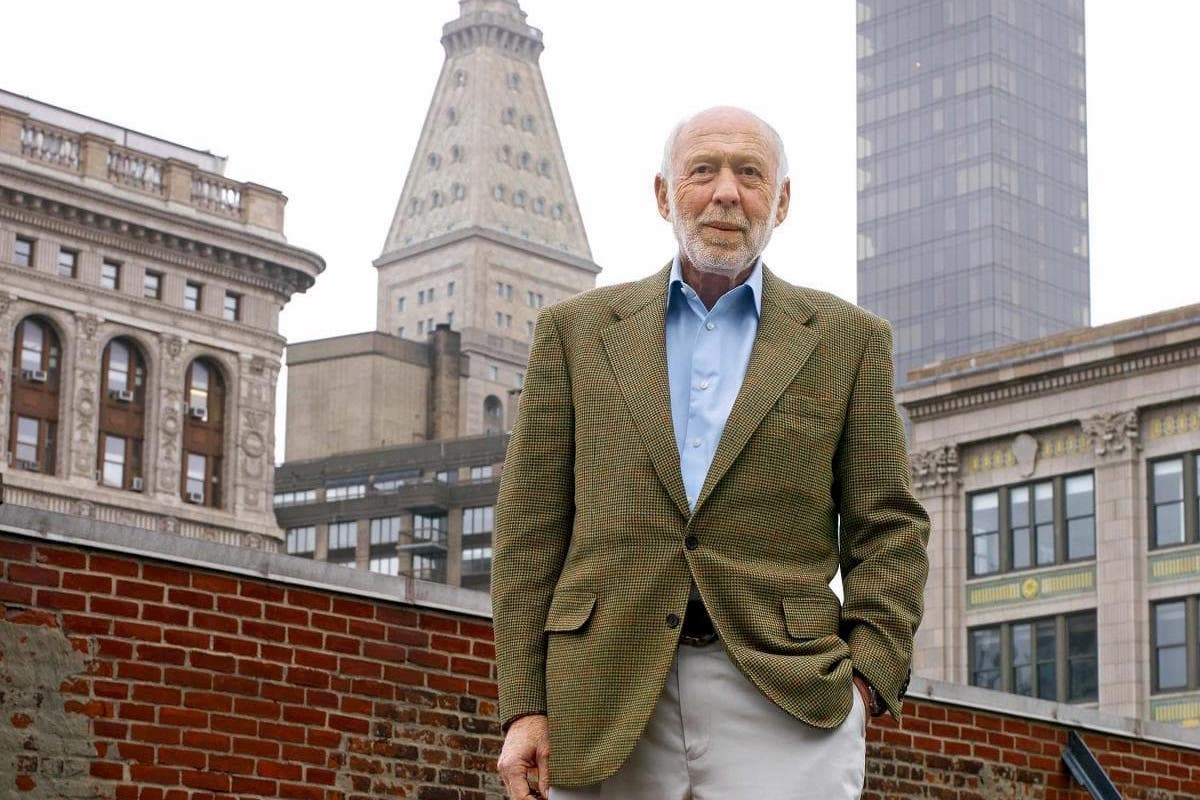

Now, are you aware of the legendary hedge fund that achieved an average investment return of over 40%?

It is Renaissance Technologies.

There is no name that resonates as strongly in the world of hedge funds as this one.

This investment company, established in New York, has built its position as a pioneer of innovation and success in the financial world.

It is known for its advanced mathematical models and algorithms.

Among them, the Medallion Fund is one of the most successful hedge funds in history.

Today, I want to talk about the genius of its founder, Jim Simons, and also discuss why we, in Japan, cannot invest in such an excellent fund.

If I start writing about Jim Simons’ exceptional abilities in detail, it would become four to five volumes of dense, specialized books, so I will keep it brief.

There is no market that continues to rise

There is no market that continues to fall

There is no investor who continues to win

However, there was one:

the biggest money-making machine in financial history, “Jim Simons.”