On June 24, I wrote an article titled “vol.489 Will the Trend of Yen Depreciation Continue? Be Cautious of a Possible Turning Point in July.” On July 1-2, I further discussed this in “vol.496-497 Unstoppable Yen Depreciation: What’s the Cause?”

489 Will the trend of a weaker yen continue? Be wary of a possible turning point in July(Clic)

496 Unstoppable Depreciation of the Yen: What is the Cause? 1/2 (Clic)

497 Unstoppable Depreciation of the Yen: What is the Cause? 2/2(Clic)

My main view is that “the trend of yen depreciation is nearing its final stage in the short-term.“

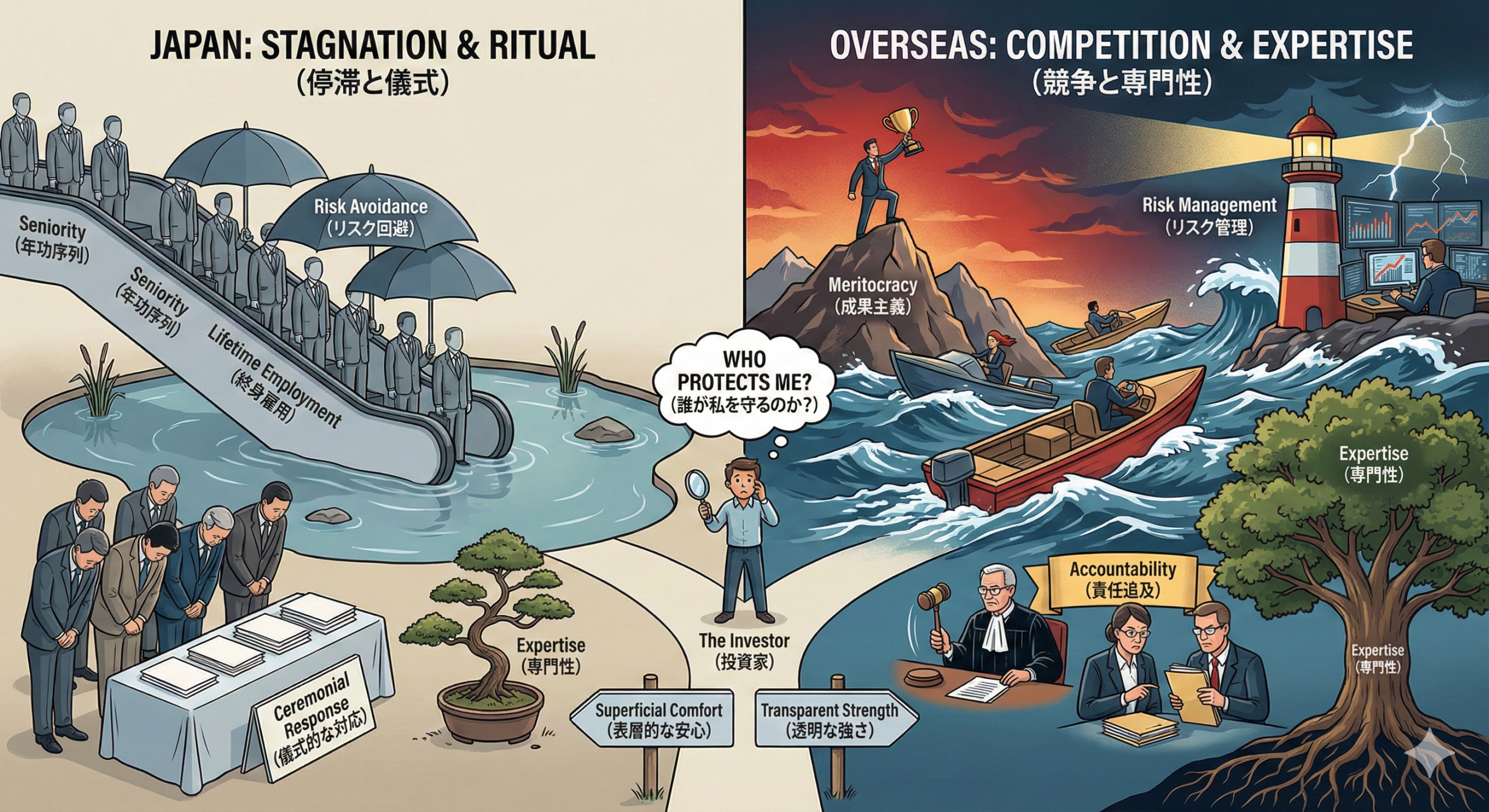

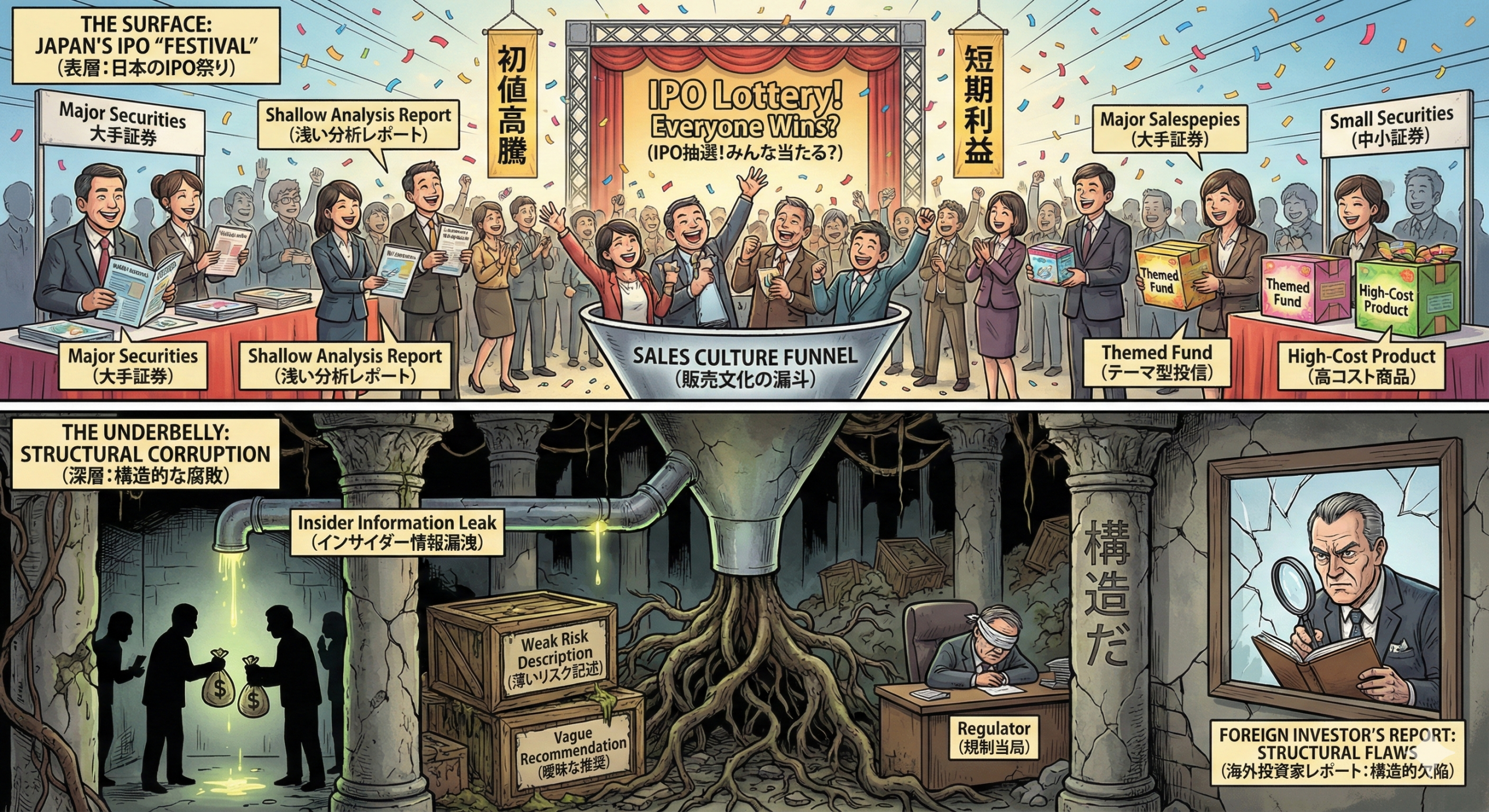

However, I also pointed out that “given the firmly established yen depreciation trend, it seems a shift in the dollar’s direction would be necessary to change its trend,” and that “it may be time for [Japanese] authorities to improve their communication with foreign investors.“

It seems the turning point arrived with the U.S. CPI for June on July 11.

The core index (excluding food and energy), which the market focuses on, rose by only +0.1% month-on-month, the lowest increase since August 2021.

In particular, the “super core” (service prices excluding housing) decreased by -0.1% month-on-month.

As a result, the market increasingly views that the Fed might cut interest rates at its September meeting, if not in July.

USD/JPY plunged from roughly 161.6 to 157.4 following the June US CPI.

Although official data on any intervention will not become available before July 31, it seems the MOF conducted interventions amounting to approximately 3.5 trillion yen.

Speaking on the morning of July 12, Vice Minister for International Affairs Masato Kanda characterized the 21-yen move in USD/JPY since the start of 2024 as an “extremely sharp” depreciation, citing “objective” evidence of “speculation” causing the yen to keep weakening despite a narrowing of interest rate differentials.