※Translated with Notion AI. (Plus version)

Gold prices are hitting record highs.

Is this due to geopolitical risks, particularly the increasing possibility of a third Middle East war?

According to a recent FT magazine:

☞Massive purchases, primarily by China, have been driving the rise in gold prices since March.

☞The influence of Western speculators has significantly decreased.

☞Chinese trading companies, like Zhongcai Futures, have been accumulating purchases of 50 tons of gold in kind in SHFE gold futures, worth about $4B.

This exceeds 2% of the gold holdings of China’s central bank.

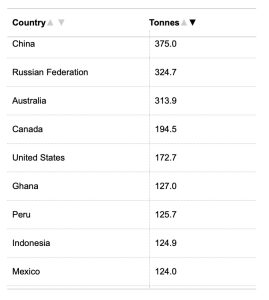

China is the world’s largest gold-producing country (clic).

However, it’s also a significant buyer of gold from other countries.

In other words, while producing a large amount of gold domestically, it’s also actively buying gold internationally.

Why is this the case?

I asked this question to a Chinese-American colleague from my days at a U.S. investment bank, who is now a professor at a university in Shanghai.