In last week’s column, I argued that no major surprises were expected from the FOMC or the BOJ meetings, and that the Japan–U.S. summit would matter far more.

Let us briefly review the central bank meetings first.

On October 29, the Federal Reserve decided to cut rates by 25 basis points as widely expected.

However, Chair Jerome Powell emphasized that another rate cut at the December meeting was “not a foregone conclusion,” sending the 10-year Treasury yield higher from around 4.0% to around 4.1%.

On October 30, the Bank of Japan decided to keep policy unchanged for the sixth consecutive meeting.

Governor Ueda cited

(1) stronger-than-expected performance in sectors such as AI and

(2) the still-limited pass-through of tariffs to consumers as reasons in judging that “downside risks to the U.S. economy have declined somewhat compared with what we saw in July.”

Still, by repeatedly stressing the need to “confirm the initial momentum ahead of next spring’s wage talks,” Ueda was perceived as cautious about further rate hikes, pushing the yen weaker to around ¥154 per dollar.

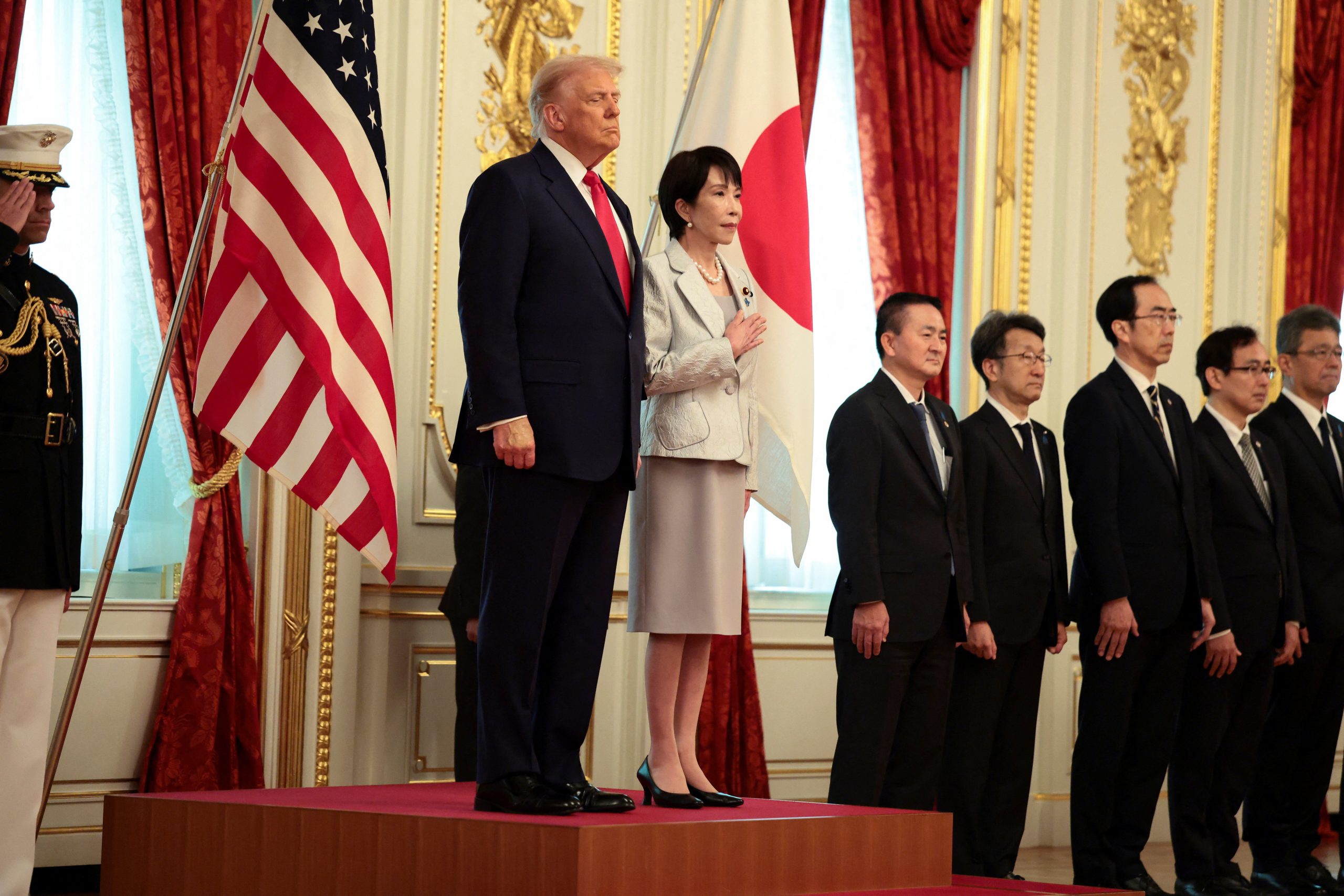

Before the BOJ meeting, there was an unusual gesture from the U.S. side.