“Are Japan’s wealthiest truly contributing to the nation?”

Japan is caught between prolonged economic stagnation and relentlessly ballooning social security costs.

Meanwhile, the super-rich continue to inflate their assets through soaring stock markets and real estate investments.

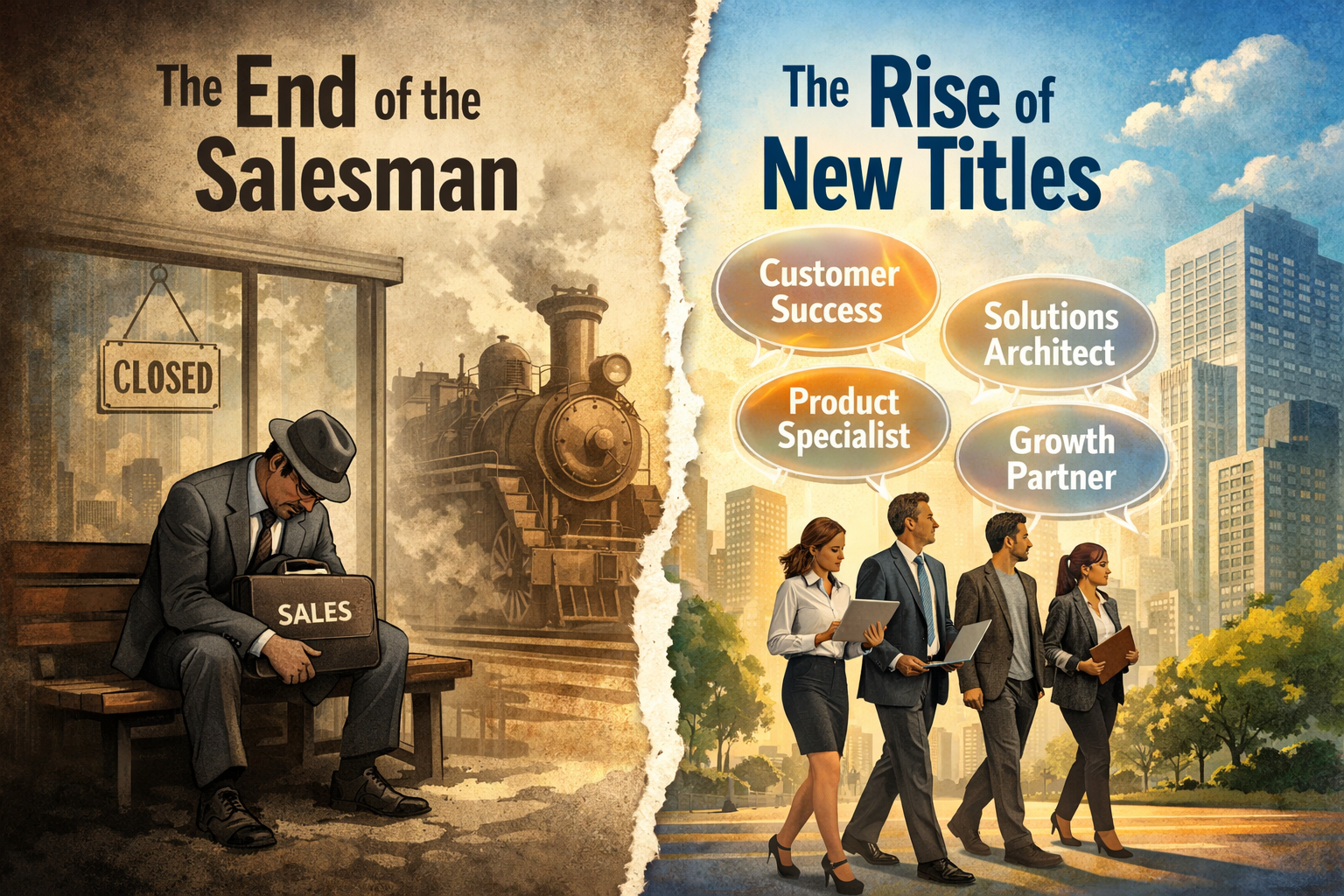

Yet, a significant portion of the wealth they enjoy is effectively maintained at a “low cost”, slipping through the gaps of the current tax system, especially due to preferential low-rate taxation on financial income.

What if Japan were to follow the lead of nations like Australia and Singapore and levy a proportionate tax on the “luxuries” they own?

This would be more than just a fiscal measure; it would be the most practical and effective first step toward restoring social fairness and compelling the “haves” to fulfill their responsibility to the “have-nots.”

It is time for Japan to seriously consider adopting the “Luxury Tax,” a measure long considered taboo.

We must also rigorously scrutinize ambiguous government spending and, as a viable option, temporarily revert the consumption (sales) tax to zero.

Furthermore, to alleviate the burden on the populace, we propose tripling the Tourist Entry Tax, targeting foreign visitors who currently benefit from the favorable yen exchange rate.

Implementing this as a form of “luxury tax” on tourism should aim to fund economic recovery and improve the quality of life for all residents.

These measures are highly likely to garner strong public support, paving the way for long-term governmental stability.

First, let us delve into the core of this tax reform: the “Luxury Tax.”