Due to the US presidential election last week, I contributed three articles on Monday, Wednesday, and Thursday.

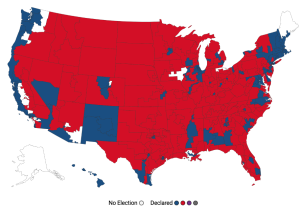

Not only did Trump win decisively, but the Republican Party has already secured 53 seats out of 100 in the Senate, including non-contested seats.

In the House, where all seats are contested in single-member districts, counting continues, but Republicans have secured 213 seats, approaching the majority threshold of 218.

Looking at the map, it’s striking how almost the entire United States is colored red (Republican).

While international investors typically consolidate their positions in November to prepare for year-end, since Trump won’t actually take office until January 20 next year, this period will likely be used to formulate future strategies.

At last week’s FOMC meeting on November 7, an additional 0.25% rate cut was announced.

While this didn’t receive much attention due to its timing right after the presidential election and meeting expectations, Chairman Powell made significant statements during the press conference.

What caught my attention was Powell’s explicit statement that downside risks to the US economy have receded.

Specifically, when Nick Timiraos, the prominent Fed watcher from The Wall Street Journal, asked about the impact of rising long-term interest rates on economic growth, Powell responded that the rate increases reflected “stronger growth and perhaps less in the way of downside risks” rather than rising inflation expectations.

While Japanese commentators often attribute recent US long-term interest rate increases to concerns about the Trump administration’s tariffs and fiscal stimulus raising inflation expectations, the Fed itself is more focused on the underlying strength of the US economy.

Powell also stated that the rate cut “will help maintain the strength of the economy and the labor market and will continue to enable further progress on inflation.”

As I’ve repeatedly pointed out, the major theme going forward remains “US economic dominance,” which will become particularly evident versus Europe.

Trump’s victory indicates a reaction against excessive “liberalism” in the US. Until now, Europe has led the world through regulations on “politically correct” initiatives like decarbonization, human rights, and diversity.

Following the conflicts in Ukraine and the Middle East, Europe’s idealistic stance has already lost support from the Global South, and at the October Commonwealth meeting, discussions about apologizing for the slave trade highlighted accusations of hypocrisy.

With Trump’s second term, the US is likely to withdraw from the Paris Climate Accord and promote unilateralism.

Europe’s moral high ground will lose its influence, and the continent will need to face its structural economic issues, including demographics (aging population and immigration) and delayed technological innovation.

The day after the US presidential election, on November 6, German Chancellor Scholz dismissed Finance Minister Lindner.

The Scholz administration, formed in December 2021, was a three-party coalition of Scholz’s liberal Social Democratic Party (SPD), the environmental Green Party, and Lindner’s market-oriented Free Democratic Party (FDP). With the FDP’s departure, it has become a minority government.

This comes as the German economy faces likely negative growth in both 2023 and 2024, and the Scholz administration’s approval rating has fallen to 14% according to October’s ARD public broadcasting survey.

A confidence vote is expected on January 15, 2025, which could lead to dissolution and new elections if it fails.

The contrast is clear: the US with a president likely to control both houses of Congress, versus Germany facing imminent dissolution.

Of course, Japan’s Prime Minister Ishiba also leads a minority government without a majority in the Lower House.

These contrasting political foundations further highlight US dominance.