The dollar’s strength continued this week, with the USD/JPY briefly surpassing 150 yen.

As mentioned last week, this reflects the “unrivaled performance of the U.S. economy,” which was further confirmed by the September US retail sales data on the 17th, showing robust personal consumption.

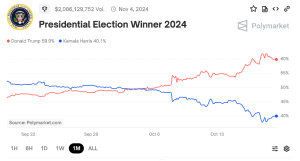

Moreover, markets are beginning to brace for the possibility of former President Trump’s victory in the November 5th presidential election.

In betting markets for the U.S. presidential race, Trump’s odds of winning have recently increased, now reaching nearly 60%.

https://polymarket.com/event/presidential-election-winner-2024?tid=1729305371044

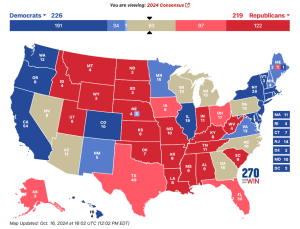

In U.S. presidential elections, states supporting Republicans and Democrats are largely fixed, with a few battleground states deciding the outcome.

Current polls suggest Republicans (Trump) securing 219 electoral votes and Democrats (Harris) 226, both short of the 270 needed to win. The election is expected to be determined by seven states: Pennsylvania, Michigan, Wisconsin, North Carolina, Georgia, Nevada, and Arizona.

https://www.270towin.com/#google_vignette

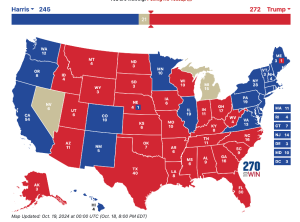

Currently, these seven states are closely contested, but polls show Trump with a slight lead.

If we color-code based on even the slightest advantage, Michigan and Nevada remain toss-ups, but Trump is projected to secure 272 electoral votes, enough for victory.

Market reactions to a potential Trump re-election currently include higher U.S. stocks, rising U.S. interest rates, and a stronger dollar.

It seems the market is accepting the view that the U.S. economy might become “great again.”

Meanwhile, foreign investors are already losing interest in the Japanese market.

The October 27th Lower House election, called unexpectedly early, caught the opposition unprepared to unify candidates.

The ruling coalition of the Liberal Democratic Party and Komeito is likely to maintain a majority despite losing seats, with no change in government expected.

However, the Ishiba administration is not expected to have a strong political foundation after the election, and it’s uncertain whether it can survive next July’s Upper House election.

Some are beginning to wonder if Japan might return to the days of changing prime ministers annually.

Japan isn’t alone in looking less attractive compared to the U.S.

The European Central Bank (ECB) decided on a 0.25% rate cut at its October 17th meeting, lowering the policy rate to 3.25%.

ECB President Lagarde explained that all information is “heading in the same direction – lower!” (Note: The exclamation mark is included in the official ECB transcript.)

Europe’s problem lies in the German manufacturing industry losing its former strength.

Volkswagen shocked many in September by announcing it was considering closing a German factory for the first time in history.

German Chancellor Olaf Scholz announced in a Bundestag speech on October 16th that he would hold meetings with business associations and labor unions to revitalize the industrial sector.

Germany faces several challenges:

(1) soaring energy prices following the Ukraine war (Germany previously imported cheap natural gas from Russia via pipeline),

(2) stagnant exports due to weak global demand,

(3) targets for net-zero emissions, and

(4) growing competition from China (especially in electric vehicles).

None of these issues are easily resolved.

Additionally, China’s real GDP for Q3, announced on October 18th, grew by 4.6% year-on-year, falling short of the government’s annual target of 5%.

Real estate investment for January-September declined by 10.1% compared to the previous year.

While the government has recently announced monetary easing measures, stock market support, and real estate market policies, without sufficient fiscal expansion to fill the demand gap, a full-fledged recovery is unlikely.

This week, the market’s main themes are likely to remain the U.S. economy’s unrivaled success and scenarios of a Trump win.